For buyers located outside the UK, we do not collect any taxes at checkout.

Most imports into your country will be subject to payment of import VAT/taxes, and other duties/fees. These will be requested by and payable to the delivery company on import, therefore it is important to understand your country’s tax rates and import customs regulations before committing to buy from our webshop.

Due to automated shipment generation processes we have in place, as well as our own obligations as a responsible exporter of goods from the UK, we are unable to make any ‘undervalue’ customs declarations, nor will we able to change the nature or ‘description’ of goods being exported.

In most countries, it is considered a criminal offence to make false customs declarations in order to avoid paying import taxes.

In the event that a package is returned to sender due to failure to pay import tax/duties, we reserve the right to deduct outbound and return shipping costs we get charged from the full refund.

Update for US buyers from April 2025

Due to new government policy, US customers who import goods over $800 from other countries may need to pay tariffs and fees, also known as duties. Tariffs, which vary by country, are usually calculated as a percentage of the shipment’s price. Tariffs are based on the country where an item was manufactured, not the country from which an item was shipped.

Additional processing fees may be charged by the shipping provider (e.g. DHL) or US Customs, and often range from $10-$30. You may be contacted by your shipping provider about duties and fees by email, text, phone call, letter, or upon delivery. It’s important to check that the message you receive is from the shipping provider.

The implementation of reciprocal tariffs has been temporarily paused for most countries for 90 days. The base tariff of 10% implemented on 5 April remains unchanged. This applies to items sold into the US from the UK and all other countries.

It’s important to note that tariffs take effect on US imports for items valued over $800*. These tariffs are based on the country of origin. For instance, for UK sellers exporting to the US and products are made in China, they’ll be subject to China’s tariff rather than the UK tariff, if the shipment exceeds $800 in value.

This formal clearance threshold remains at $800 after being lowered from $2,500 on 5 April. This means US buyers will need to provide a Social Security or Tax ID number for these shipments for formal entry.

*Effective May 2, 2025, goods of any value from China and Hong Kong will be subject to duties.

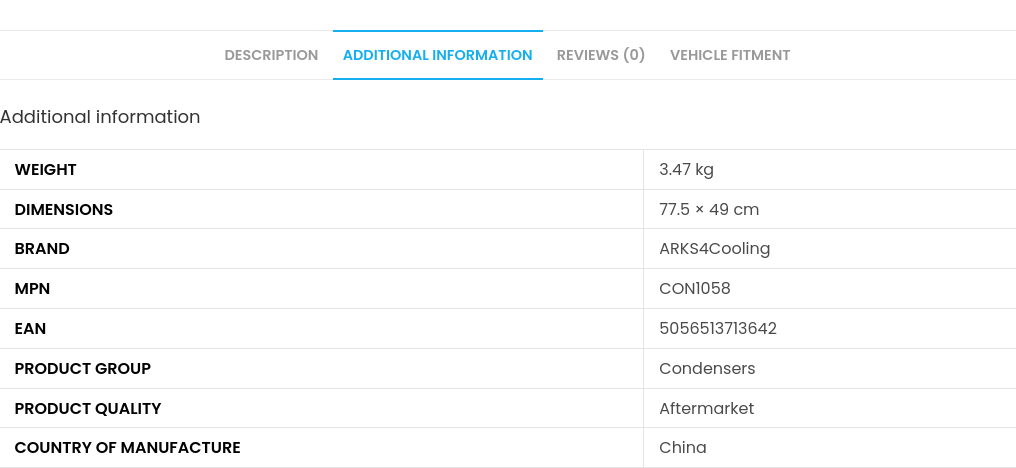

For the benefit of international buyers, the Country Of Manufacture is now being added to product detail pages, see ‘Additional Information’ section.